If there’s one term that has exploded in search engines in 2023, it is Artificial Intelligence (AI). With the arrival of ChatGPT, everyone is trying to understand what it implies for them and what the future holds.

No doubt that it’s a common buzzword today, but the concept of AI has existed for a long time. The first official recognition can be traced to a 1956 workshop, called the Dartmouth Summer Research Project where leading scientists talked about the possibilities of creating machines that could learn, reason and solve problems like human beings.

In the world of finance, AI gained prominence in the 1980s when expert systems or intelligence systems that were based on knowledge were used to predict market trends and provide customized financial plans.

Fast forward to 2023, and decision-makers are deliberating how to tailor their business strategy around Artificial Intelligence. In fact, AI is expected to “save the banking industry more than $1 trillion by 2030,” according to a report by The Financial Brand.

Before we begin, let’s quickly understand how the fintech industry is shaping up. Global fintech funding reached $75.2B in 2022 — down 46% from 2021, but up 52% compared to 2020. The US leads in funding and deals, followed by Europe and Asia in Q4’22. The industry is poised to grow exponentially and leverage AI significantly.

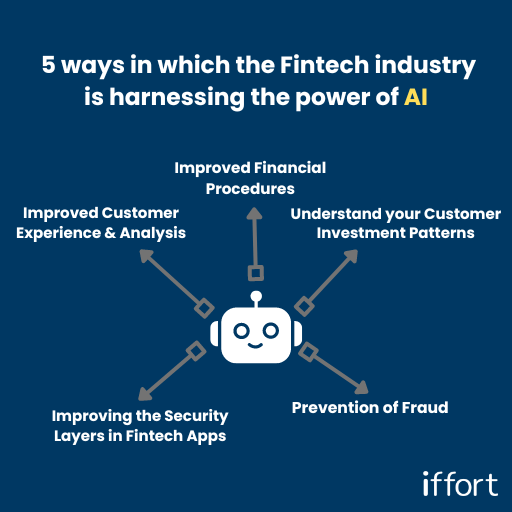

Here are 5 ways in which the Fintech Industry is harnessing the power of Artificial Intelligence.

1. Improved Customer Experience & Analysis

The most common function of AI that is used by various financial and nonfinancial institutions is deploying Chatbots and virtual assistants for immediate customer response. AI-based trained data models for natural language processing (NLP) and natural language generation (NLG) let chatbots understand and communicate with humans in a natural voice and text languages. This uses a combination of big data and predictive analysis to anticipate the requirements of the customer and their preferences. In addition, machine learning can also be used to segment customer profiles and personas.

2. Improved Financial Procedures

Artificial Intelligence is also being utilised to improve financial procedures. AI-powered solutions automate financial transaction processing and provide fintech companies with improved insights into their financial data. AI help businesses grow and improve financial forecasts and discover possible cost-cutting options.

3. Understand your Customer Investment Patterns

Fintech companies are increasingly using AI to analyse customers’ investment histories and identify market trends to offer key investment forecasts about the sectors that are lucrative or can be considered. AI can understand the purchase pattern or the customer investment patterns using machine learning, which can help understand how a typical customer behaviour pattern looks. With the help of AI and machine learning, it is now easier to go through different amounts of vast data from past financial and nonfinancial transactions and bifurcate customers into different profiles. This helps in predicting the future transaction of that current customer.

For example, categorisation can be like ‘watching cinemas on weekends’ or ‘making regular foreign trips.’ So, as transactions are made, AI can determine whether or not it fits a pattern or departs enough from the norm to warrant being flagged.

4. Improving the Security Layers in Fintech Apps

One of the biggest concerns with transactional applications is their security. However, with Artificial Intelligence, applications get additional security. For example, fintech apps have become more secure with a combination of facial along with fingerprint and speech recognition authentication. Biometric and voice recognition has the ability to prevent the misuse & leakage of personal information by simplifying the identification process of various fintech apps. Also, as biometrics and other advanced AI techniques are rapidly increasing, users are getting more reliant on biometrics. In the coming future, biometrics has the potential to change the user experience.

5. Prevention of Fraud

In the 1990s, there was a huge hype about a fraud detection system. During the time it was operational, the FinCEN Artificial Intelligence system (FAIS) reviewed over 200,000 transactions per week and identified 400 potential money laundering cases worth nearly $1 billion.

Fast forward to 2023: AI can detect fraudulent activities and notify customers in real-time. Currently, the most common type of fraud is phishing, a method of obtaining personal data like login information, passwords, or any other details via mail or SMS.

Thanks to advanced analytics and AI, now fintech can companies predict the possibility of fraud and help avoid it before it occurs. If they detect fraud by any means, they can immediately flag suspicious activity and take further steps with the help of various automation tools. By engaging AI techniques instead of relying on a rule-based approach, fintech companies gain the upper hand in detecting the often subtle correlations between customer behaviour and fraudulent potential.

With updated fraud detection mechanisms, fintech firms’ reputations and brand image are safeguarded as any fraudulent activities are controlled, thereby preventing customer data misuse.

Conclusion

In a nutshell, AI allows fintech startups to provide more personalised and convenient customer service. There are various AI use cases that can assist various fintech startups in enhancing their understanding of customers, automating customer service that can help in retaining them, detecting fraud, and improving the customer experience.

It is argued that in the future, there will be a significant increase in banking-related chatbot interactions. The only challenge that needs to be addressed by financial companies is regulations. Financial companies are also relying heavily on patterns and insights created by AI and machine learning algorithms, which further help brands maximise their profitability. As a result, fintech application development services are much in demand.

Are you looking for a development partner to design a cutting-edge financial application using AI?

Connect with Iffort, your digital technology and marketing partner. We incubate startup ideas and bring product-level thinking to the core.